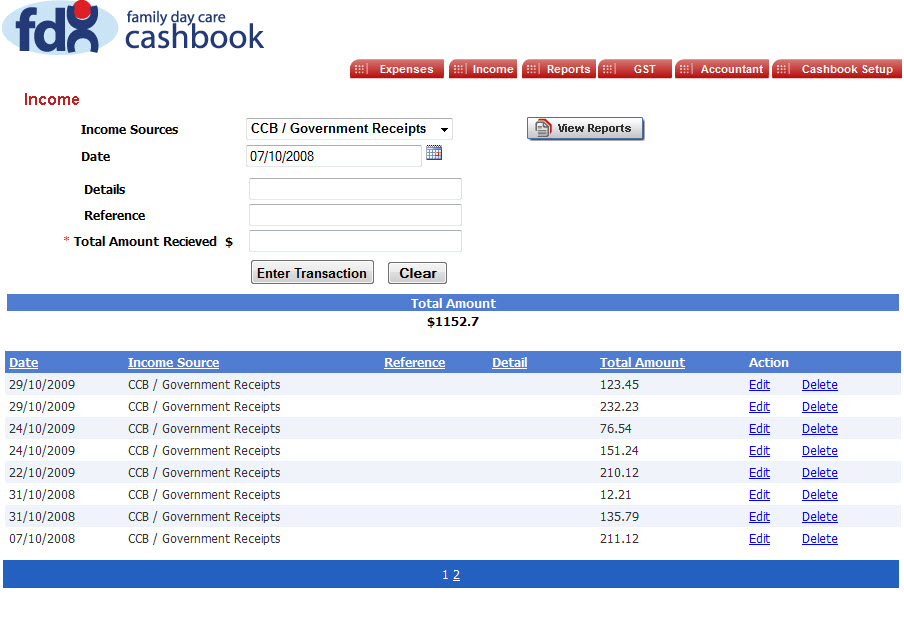

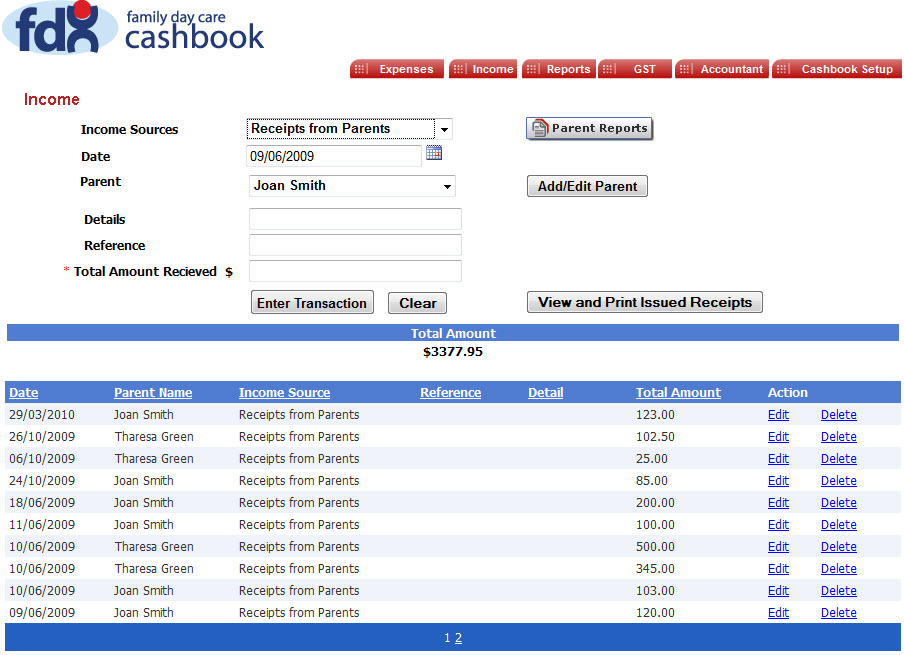

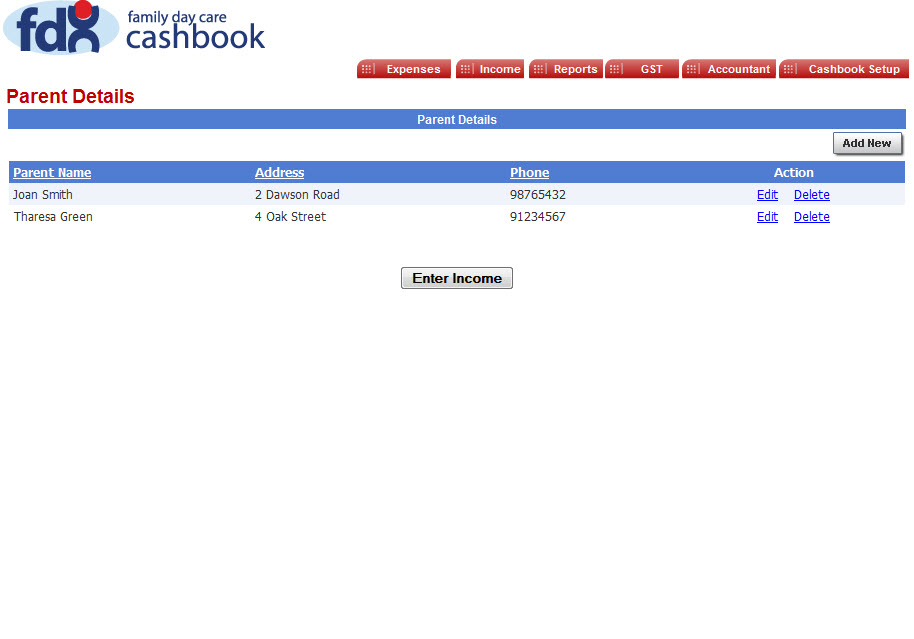

Income

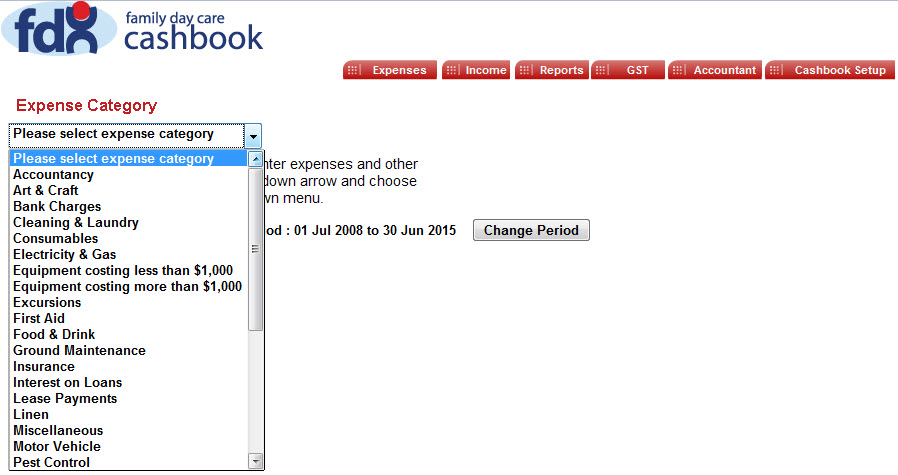

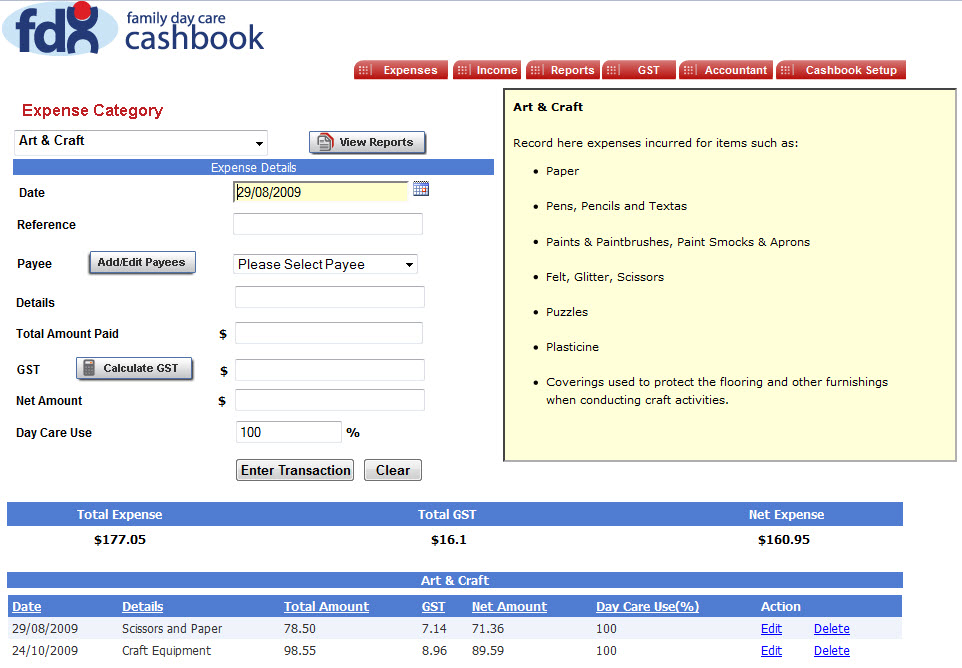

Expenses

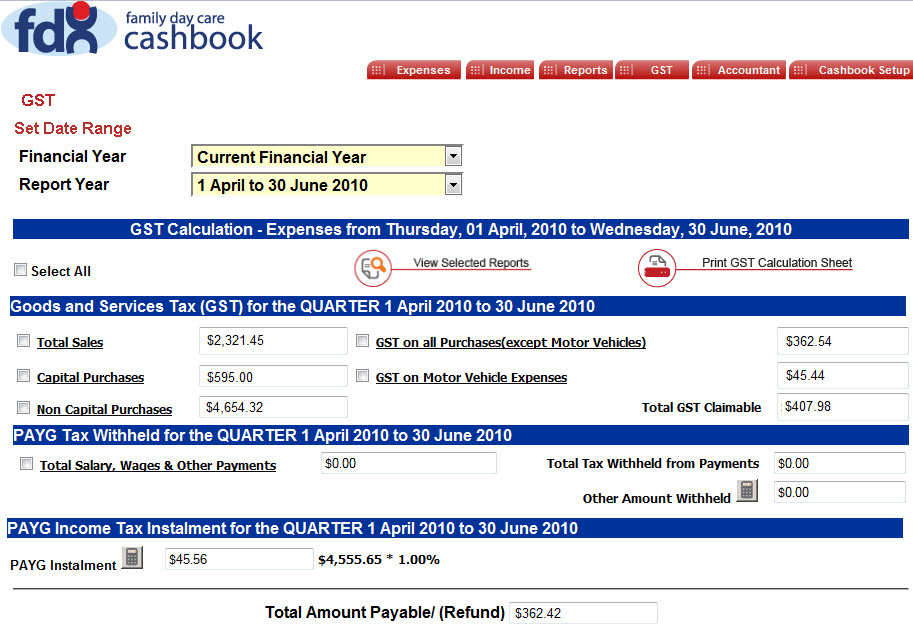

GST

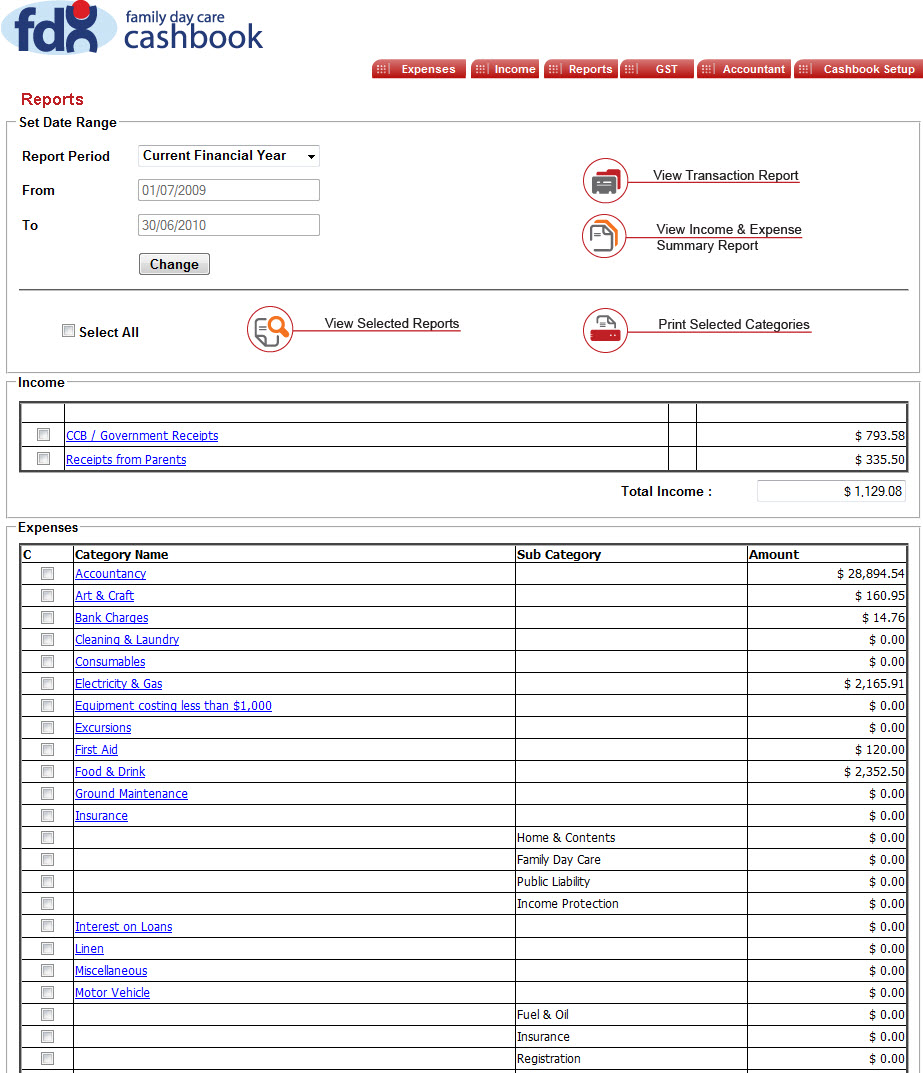

Reports

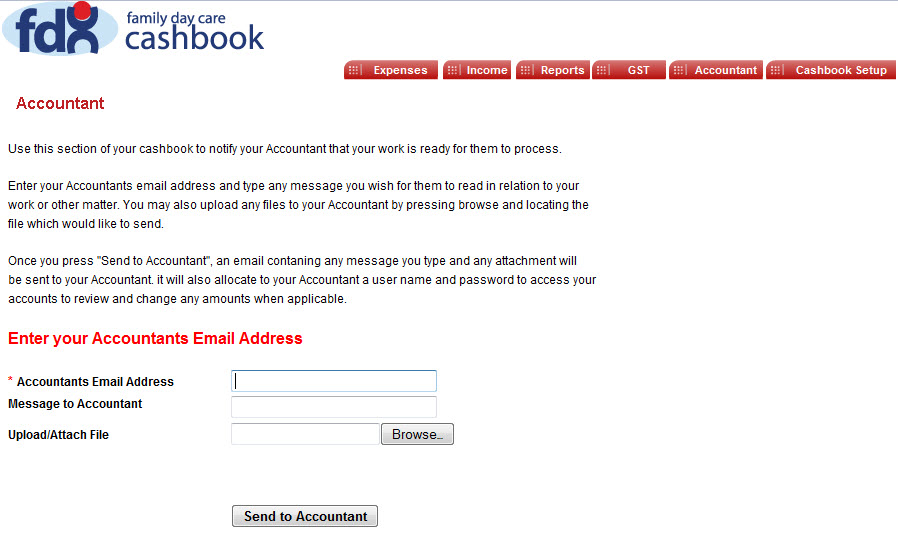

Accountant

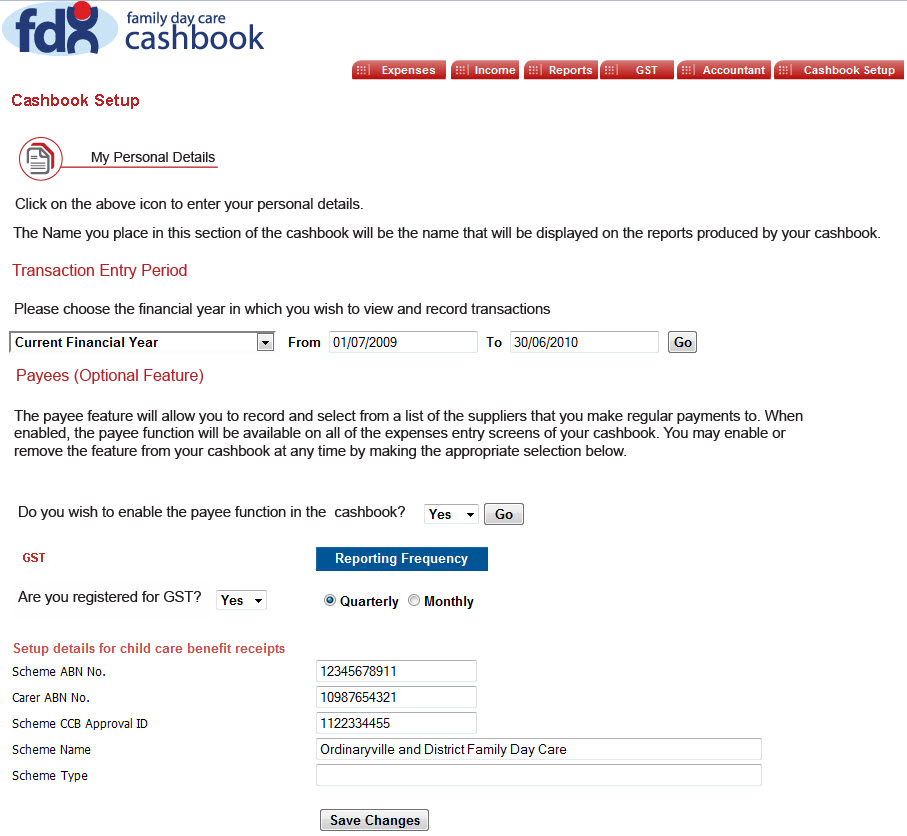

Cashbook Setup

- Record all your day care income

- Issue receipts to Parents.

- Issue receipts to Parents.

All accounts for Family Day Care have been set up. All you need to do is login and start entering your receipts

Tax Information and Tips on every screen

Automatically calculates GST

If you are not registered for GST, simply switch off the GST function and forget about it.

Tax Information and Tips on every screen

Automatically calculates GST

If you are not registered for GST, simply switch off the GST function and forget about it.

GST is automatically calculated and reported so you can just enter the totals on your BAS ready for lodgement

Calculates GST for Monthly, Quartely or Annual BAS Statements

Easy to prepare and lodge your own BAS

Calculates GST for Monthly, Quartely or Annual BAS Statements

Easy to prepare and lodge your own BAS

Income and Expense Report

Transaction Listing

Detailed Account Reports

Transaction Listing

Detailed Account Reports

Enter your Accountants email and press send. You Accountant will receive an email for them to enter your cashbook to view your information, make any applicable changes, and produce the reports they require. No need for backups.

Choose period of entry to avoid errors

Turn GST functionality on/off allowing to tailor to your GST registration details

Turn GST functionality on/off allowing to tailor to your GST registration details

The Family Day Care Cashbook has the features you need to easily and effectively record your income and expenses. The main features of the cashbook are outlined below. Click to the images shown below to enlarge and view.